The company said that i have to pay personal income tax on non-resident rate during the time 75 months and then the tax deducted in 2017 112017 to 1572017 will be refunded while the tax deducted in Dec-2016 will not be refund. Total tax reliefs RM16000.

New York State Enacts Tax Increases In Budget Grant Thornton

Annual income RM36000.

. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. While the 28 tax rate for non-residents is a 3 increase from the previous years 25. Assessment Year 2016 2017 Chargeable Income.

For the year of assessment 2015 for the same bracket of chargeable income it was 25 and. Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non-residents are subject to withholding taxes on certain types of income. It looks more like this.

Read Personal Income Tax Rebate and Personal Income Tax Relief for details. Rate TaxRM A. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Personal Income Tax Rate in. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN.

Historical Chart by prime ministers Najib Razak. The below reliefs are what you need to subtract from your income to determine your chargeable income. Non-resident individuals Types of income Rate.

GST collection up RM39bil from RM27bil in 2015. On the First 5000 Next 15000. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

On the First 5000 Next 15000. Others Also Read Load more. CORPORATE INCOME TAX 12 Chargeable Income YA 2015 YA 2016 The first RM500000 20 19 In excess of RM500000 25 24.

Malaysia Personal Income Tax Rate was 30 in 2022. Other income is taxed at a rate of 26 for 2014 and 25 for 2015. If you have no clue what the answers for these questions are plus many other income tax-related questions you will have no idea how to plan your taxes well.

Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Malaysia. Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a. In Malaysia 2016 Reach relevance and reliability.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. Choose a specific income tax year to see the Malaysia income tax rates and personal allowances used in the associated income tax. Chargeable income RM20000.

Join our Telegram channel to get our Evening Alerts and breaking news highlights Found a mistake in this article. On the First 2500. New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015.

Personal income tax rates. Personal Tax 2021 Calculation. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate 11 Business environment.

Income tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 from 25 to 26 and chargeable income exceeding RM1000000 be increased by 3 from 25 to 28 from. Income tax for those earning between RM600k-RM1 million to be. The fixed income rate for non-resident individuals be increased by three percentage points from 25 to 28.

2016 Malaysia Open Grand Prix Gold. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Revenue to grow 14 to RM2257bil on higher tax revenue in 2016.

Total tax amount RM150. Tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased 1. Report it to us.

Resident companies are taxed at the rate of 25 reduced to 24 wef YA 2016 while those with paid-up capital of RM25 million or less are taxed at the following scale rates. 25 percent 24 percent from year of assessment ya 2016 special tax rates apply for companies resident in malaysia with an ordinary paid-up share capital of myr 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary paid- up share capital of the company is. On the First 5000.

Calculations RM Rate TaxRM 0 - 5000. Resident individuals are eligible to claim tax rebates and tax reliefs. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Ali work under real estate company with RM3000 monthly salary. No guide to income tax will be complete without a list of tax reliefs.

For single individuals aged above 21 years old earning less than RM2000 a month assistance has been raised from RM350 to RM400. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. It should be noted that this takes into account all your income and not only your salary from work.

Malaysia Personal income tax rates 20132014 Below are the IndividualPersonal income tax rates for the Year of Assessment 2013 and 2014 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. Income Tax for Non-Resident Individual. As a non-resident youre are also not eligible for any tax deductions.

Who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. Chargeable Income Your chargeable income is best illustrated with an example like so.

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

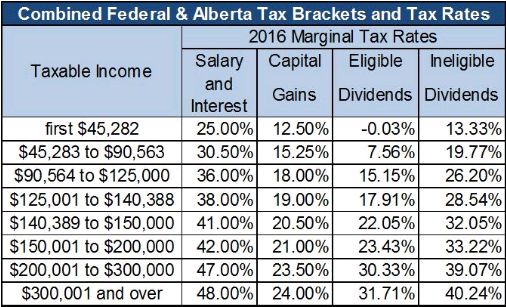

2016 Alberta Budget Capital Gains Tax Canada

Malaysian Tax Issues For Expats Activpayroll

Tax Guide For Expats In Malaysia Expatgo

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Tax Guide For Expats In Malaysia Expatgo

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tax Guide For Expats In Malaysia Expatgo

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More